Homeowners Insurance in and around Columbus

Columbus, make sure your house has a strong foundation with coverage from State Farm.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Midland

- Cataula

- Fortson

- Ellerslie

- Waverly Hall

- Upatoi

- Hamilton

- Pine Mountain

- Box Springs

- Geneva

- Buena Vista

- Phenix City

- Smith Station

- Salem

- Fort Mitchell

- Pittsview

- Hurtsboro

- Cusseta

- Auburn, AL

- Opelika, AL

- Columbus, GA

- Talbotton, GA

- Crawford, AL

- Lumpkin, GA

What's More Important Than A Secure Home?

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance is necessary for many reasons. It protects both your home and the things inside it. In the event of a fire or falling trees, you may have damage to some of your possessions as well as damage to the home itself. If your belongings are not insured, the cost of replacing your items could fall on you. Some of your valuables can be insured against damage or theft outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

Columbus, make sure your house has a strong foundation with coverage from State Farm.

Apply for homeowners insurance with State Farm

Protect Your Home With Insurance From State Farm

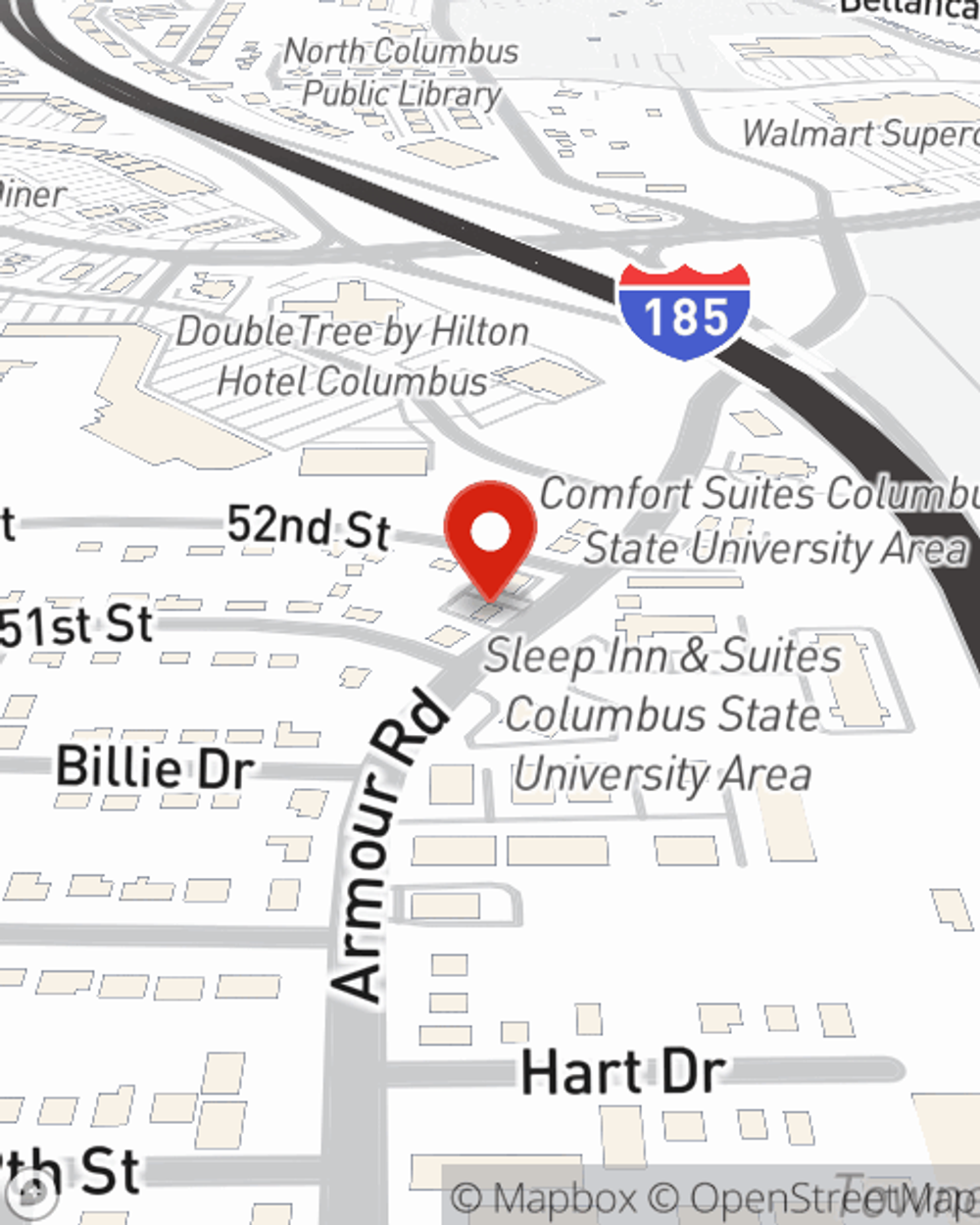

Great coverage like this is why Columbus homeowners choose State Farm insurance. State Farm Agent Rick Hill can offer coverage options for the level of coverage you have in mind. If troubles like wind and hail damage, identity theft or sewer backups find you, Agent Rick Hill can be there to help you file your claim.

Ready for some help understanding the policy that's right for you? Call or email agent Rick Hill's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Rick at (706) 324-0161 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Why attic ventilation matters

Why attic ventilation matters

Proper attic ventilation is important, especially for homes located in climates where snow, ice dams and humidity problems are common.

What to know about fire-resistant homes

What to know about fire-resistant homes

Simple maintenance, proper material choice and leading practices can help make the outside of your home more fire resistant.

Simple Insights®

Why attic ventilation matters

Why attic ventilation matters

Proper attic ventilation is important, especially for homes located in climates where snow, ice dams and humidity problems are common.

What to know about fire-resistant homes

What to know about fire-resistant homes

Simple maintenance, proper material choice and leading practices can help make the outside of your home more fire resistant.